Turkey Economy Overview 2024

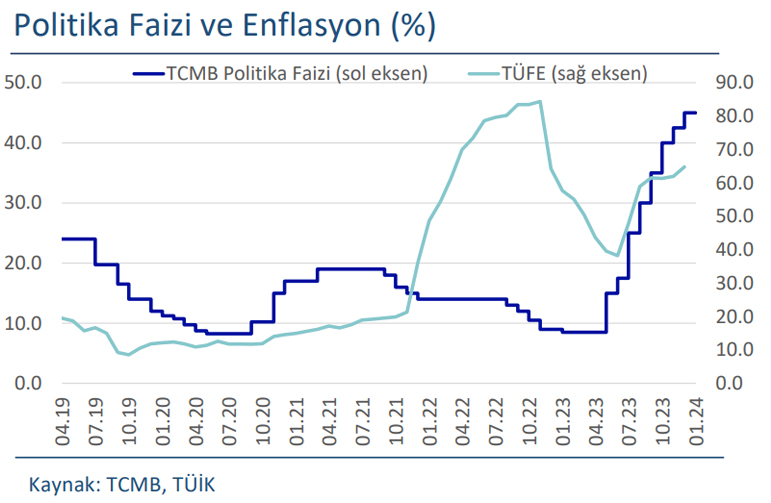

2023 was a year in which the direction of the macroeconomic policies favoured in the Turkish economy over the past 6-7 years changed. While the economic management that changed after the May 2023 elections returned to traditional policies, the CBRT also introduced a new interest rate in terms of fighting inflation. entered the auction process. The policy rate, which was 8.5% in June, rose to 4.5% by the end of the year and to 45% in January 2024, resulting in a significant tightening of monetary policy. As a result of the sudden change in the CBRT presidency in February 2024, Gaye Erkan resigned and Fatih Karahan, one of the vice presidents, was appointed. In our view, the change will not lead to a change in policy.

We also saw the impact of this policy reversal on the country risk premium. The TR CDS, which had previously risen to 900 bps, fell from 700 bps in May to below 300 bps at the end of the year. We expect this reduction in the sovereign risk premium to be permanent, with a gradual increase in sovereign credit quality in 2024.

In addition to the steps taken by the new economic management in the area of monetary policy, the fact that it is carrying out a high level of consultation, both internally and externally, has a positive impact on the markets. In this process, we see that some of the domestic capital needs have been met and the CBRT’s reserves, which stood at $98 billion in May 2023, increased to $145 billion at the end of the year. (Latest data: 137 billion dollars, January 2024). We can say that we have entered a period where the foreign exchange needs of the Turkish economy, which has been under balance of payments pressure for a long time, are more relaxed compared to last year.

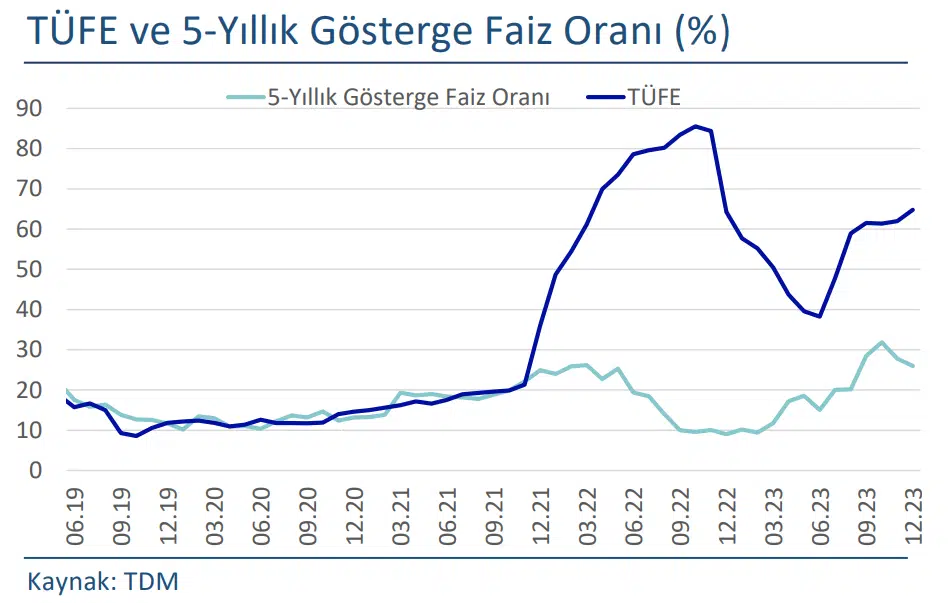

On the inflation front, 2023 ended successfully in both developed and developing countries. We expect a rapid decline in the summer months, after inflation in the Turkish economy ended the year at 65% and rose to 75% during the year. As a result, we expect to end 2024 with annual inflation of around 48%.

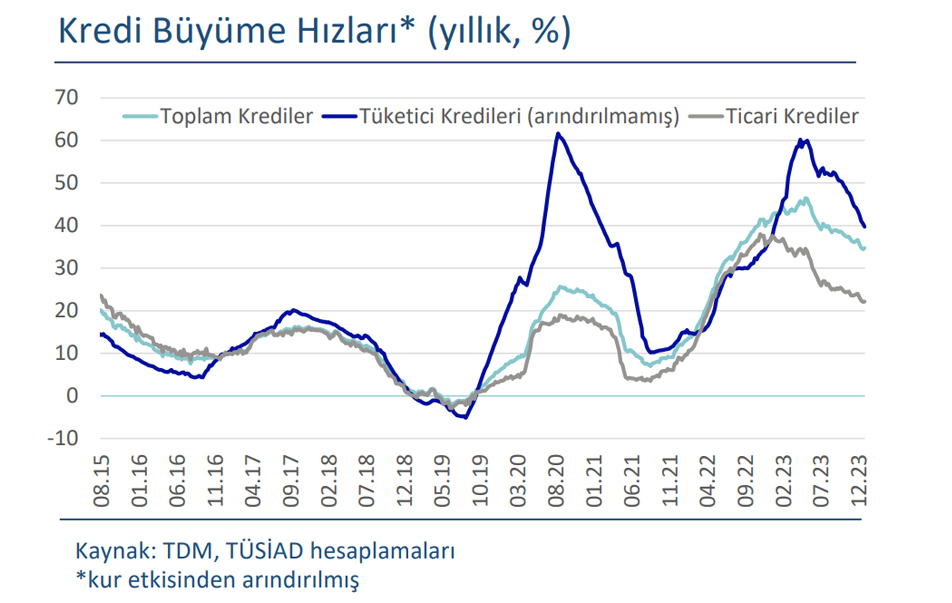

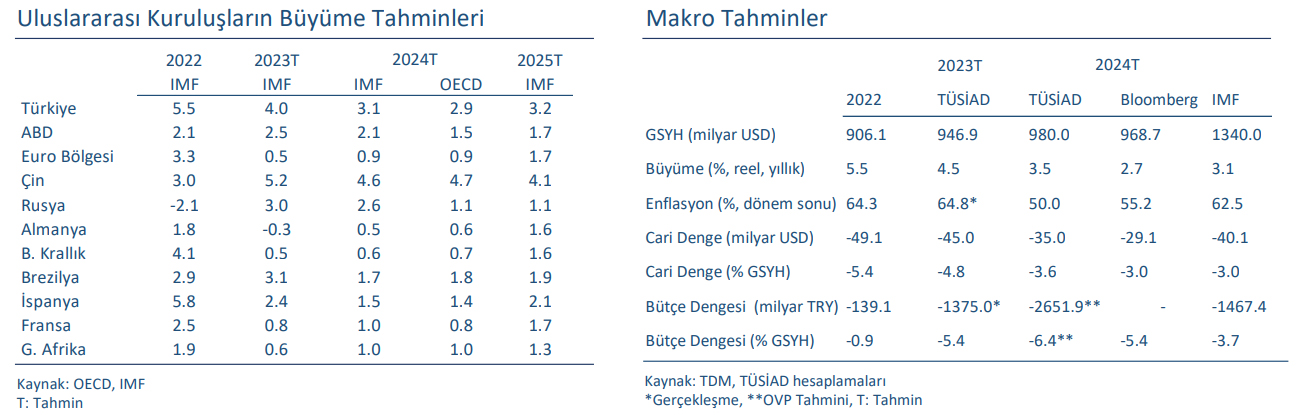

The manufacturing sector, which has long been under pressure on the growth side, is unlikely to perform strongly in 2024. Both the increase in loan interest rates and the fact that the increase in minimum wages is an important cost element show that growth in the industry will remain limited in 2024. On the export side, the lack of demand, especially from the foreign market, suggests that the weak performance in 2023 will continue in 2024.

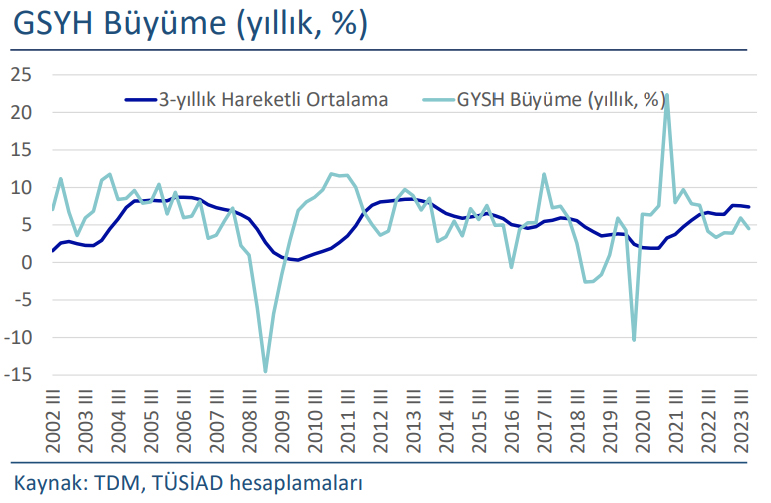

Household consumption, which is an important component of domestic demand, continues to be the strongest contributor to growth and is maintaining its strength, albeit at a slower pace. This extreme vitality of domestic demand and the fact that demand is being pushed forward in an inflationary environment make the fight against inflation more challenging. We expect the economy, which will grow by almost 5% in 2023, to slow to 3% in 2024.

On the fiscal side, while we are working on a budget deficit proportional to the official MTP figure estimated for 2024 (6.4% of GDP), we expect the current account deficit to be in the range of USD 30-35 bn in 2024, assuming a slowdown in the economy.

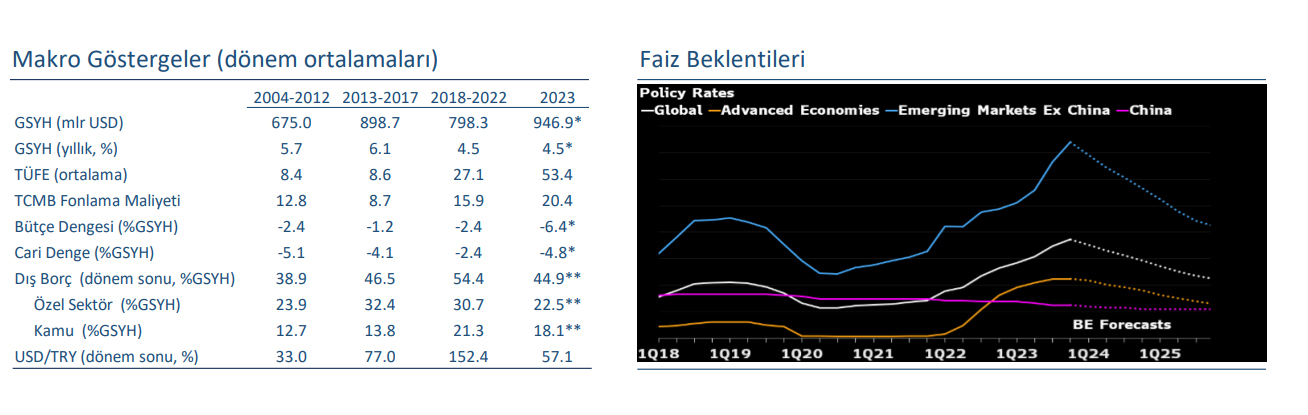

While the text of the Central Bank of the Republic of Turkey’s monetary policy for 2024 indicates that monetary tightening will continue, the message is also that quantitative tightening will continue. The critical question mark for monetary policy in 2024 will be when the easing will begin.

2023 was an active year for monetary policy in Turkey. In the first half of the year, leading up to the elections, the loose monetary policy that had been in place for some time continued. During this period, inflation remained high due to the effects of the loose monetary policy. Although annual inflation, which reached 85 percent in 2022, declined in the first half of 2023 due to the base effect, it remained in the headlines.

The increase in policy rates was also reflected in lending and deposit rates. The average interest rate on deposits exceeded 50 per cent, reaching its highest level in recent years. In addition to monetary tightening, the CBRT also implemented quantitative tightening measures during this period. While there was excess liquidity in the market for various reasons, the CBRT took steps to withdraw this surplus from the market through several methods. The TL warehouse purchase tender, which was reapplied after 17 years, stood out as one of these steps.

While 2023 was such an environment in terms of monetary policy, attention has turned to the path for 2024. Early signals for 2024 suggest that monetary policy will remain tight. The guidance given by the CBRT in its recent interest rate decisions also points in this direction. While the CBRT has stated that the tightening will be completed soon, it has also stated that the tightening will continue in 2024. While there has been a moderate improvement in inflation expectations, there is a general expectation that the high path of inflation will continue in the first half of 2024. In this context, the CBRT believes that inflation will peak at 70 percent in May 2024. All this supports the view that the tight monetary policy stance will continue for a significant part of 2024.

However, along with monetary tightening, quantitative tightening is expected to continue. There seems to be some interest in the CBRT’s first TL warehouse purchase tenders.

In 2024, voters in many countries around the world will go to the polls. In terms of global markets, the US elections will be closely watched.

The world will be voting in 40 national elections, starting with Taiwan in January and continuing through to the US presidential election in November. Voters whose diversity represents 41 per cent of the world’s population and 42 per cent of its GDP will have the chance to choose a new leader next year.

In recent years, Turkey has witnessed a significant evolution in its financial landscape, with credit scoring playing a pivotal role in shaping lending practices and financial inclusion. Recent developments in credit scoring mechanisms have been of particular interest, as they not only reflect the country’s economic development, but also have far-reaching implications for consumers and businesses alike. Let’s take a look at the latest news on credit scoring in Turkey and its implications.

1. Introduction of Comprehensive Credit Reporting:

One of the most significant developments in the area of credit scoring in Turkey has been the introduction of comprehensive credit reporting systems. These systems collect a wide range of financial data, including credit card payments, loan repayment history and other financial transactions, to provide a holistic view of an individual’s creditworthiness. This shift from traditional credit scoring models has enabled lenders to make more informed decisions, resulting in greater access to credit for borrowers with limited credit histories.

2. Increased Focus on Financial Inclusion:

The introduction of comprehensive credit reporting has also spurred efforts to increase financial inclusion in Turkey. By incorporating alternative data sources, such as utility payments and mobile phone usage, into credit assessments, lenders can extend credit to previously underserved segments of the population. This inclusive approach not only fosters economic growth, but also empowers individuals and small businesses to participate more actively in the financial system.

3. Growing Importance of Credit Education:

As credit scoring becomes more entrenched in Turkey’s financial landscape, there is a growing recognition of the need for credit education among consumers. Understanding how credit scores are calculated, the factors that influence them and the importance of maintaining a positive credit history has become essential for individuals seeking to improve their financial standing. As a result, financial literacy initiatives and education campaigns have become an integral part of the Turkish credit ecosystem.

4. Embracing Technological Advancements:

Technological innovation has also played a crucial role in shaping the evolution of credit scoring in Turkey. The rise of fintech startups and digital lending platforms has introduced innovative approaches to credit scoring, leveraging big data analytics, machine learning and artificial intelligence to improve predictive accuracy and streamline lending processes. These advances not only speed up credit approvals, but also enable lenders to more effectively meet the diverse needs of their customers.

5. Regulatory Framework and Consumer Protection:

In the midst of these developments, regulatory oversight and consumer protection have emerged as key concerns. The Turkish authorities have implemented robust regulations governing the collection, processing and sharing of credit information to protect consumer privacy and prevent misuse of data. In addition, measures such as mandatory credit report disclosure and dispute resolution mechanisms ensure that individuals have recourse in the event of inaccuracies or discrepancies in their credit reports.

6. Challenges and Future Outlook:

Despite the progress made in Turkey’s credit scoring landscape, several challenges remain. Ensuring the accuracy and reliability of credit data, addressing privacy concerns, and promoting responsible lending practices remain ongoing priorities. Moreover, as the financial ecosystem continues to evolve, stakeholders must remain vigilant to emerging risks and vulnerabilities.